What You to Need Know About Buying an Older Home in Florida

Maybe you've been living in a nice apartment for a decade, or perchance y'all're just a few years out from higher or a vocational program. Either way, you're probably feeling the demand for a real home. And then how do you lot make it happen?

On the surface, the idea of buying a home seems pretty straightforward, but there are many important details to piece of work out before you're ready. These 30 tips and questions will help yous get in that location in i piece.

Understand Why You lot Want to Buy a Firm

The very first thing to exercise before taking this giant leap is figuring out why it is you desire to buy a home. Doing so volition let you lot determine if yous have the resources to realistically acquire a house you'd be happy with and understand what you need to look for moving forward.

Write out your reasons so y'all tin visualize all your motives at once. Call up, while yous tin can ever modify apartments if you demand more space or a better school commune, a house is long-term commitment. Your reasons for wanting a house need to be ones that volition stay abiding over the coming years.

Your credit score is plays a huge part in your ability to purchase a home. A good score will aid you save money through depression-interest loan rates and brand y'all more appealing as a potential homeowner and borrower overall.

If your score is lower than 700, you've got some work ahead of you. Yous may need to postpone the search for a while until y'all've got a ameliorate score, else you might air current up with a mortgage that costs more than you can afford in the end.

Salve Up for Your Down Payment

While much of your mortgage will probable exist paid off in the future, you lot nonetheless need to save up a sizable corporeality for a downpayment on your get-go dwelling house. On the upside, the more you lay downwards yourself, the less y'all need to borrow from a banking concern.

You need to put down at least 20 pct of the total cost of the house to avoid a private mortgage insurance policy (PMI), which significantly increases your monthly payments. Past paying more upward front end, you save loads in the long run.

Learn the Meaning Behind Those Fancy Real Estate Terms

There are tons of terms you'll hear tossed effectually while you're in the process of purchasing a house, and it's of import that you sympathize what they hateful. While a good amanuensis or trustworthy depository financial institution will often explain such terms if you ask, information technology's best if you sympathize them before looking for a firm — subsequently all, not all agents and banks are looking out for your interests.

Words and phrases you'll hear and need to understand include the assessed value, bad championship, home warranty, fixed-rate, and adaptable-rate mortgage."Written report them to know what it is yous're agreeing to with your loan officer, realtor and the seller of your new house.

Get Pre-Blessing for Your Home Loan Before You lot Start Shopping

Some other financially of import matter to practise before looking for houses is to get your loan pre-approved. Pre-approval not only lets you know how much you can borrow from the depository financial institution, only it as well lets sellers know that yous tin follow through on any offer you make.

If y'all're pre-approved for more money than you actually desire to spend, sellers may take that as a signal to raise their asking toll or refuse to negotiate. Nevertheless, many banks are willing to provide you lot with a letter of the alphabet of approving that's actually lower than the real amount. It'due south a useful play a trick on.

Use a Trusted Realtor

As you brainstorm your journey to a new dwelling, information technology'southward critical that yous find a realtor that you trust. The all-time and easiest way to do that is to ask around among coworkers, family and friends that live in the approximate area to which you programme to move.

If you don't know anyone who'south recently worked with an agent, yous tin can review brokerages and agencies on sites like Yelp and Google. Just be sure to read the reviews thoroughly to determine that they oasis't paid for positive reviews or are the victim of multiple negative reviews from one or ii disgruntled people.

Remember That Buying a Business firm Involves a Contract

Ownership a business firm is all virtually contracts: ones with your bank, the seller of the house, and more than. Y'all're signing important legal documents that will bear upon your life for years to come, so make sure y'all read the fine print.

Continue in mind that just like a chore contract, some of these agreements can exist negotiated. This is particularly true of your deal with the seller — don't be afraid to come in beneath their asking cost if your realtor think information technology isn't worth it or ask for concessions.

Clearly Communicate Your Vision to Your Agent

For your real estate amanuensis to truly assistance you notice what you lot're really looking for, information technology'due south important to not only have established your ain goals for a house, only too to conspicuously communicate them to your realtor. If there'southward a particular blazon of home you love or despise, let that be known right off the bat.

Don't waste time looking at ranches if you detest single-story homes. Instead, communicate your must-haves and dreamy ideals. You lot never know what houses your realtor may be aware of, and their entire job is finding a firm that works for you.

Buy the Home You Need in The Near Futurity, Not Just Today

From kids to new jobs to lifestyle changes, odds are your needs and desires aren't going to stay the same over the coming decade. And since you're buying a house, not renting you desire to make certain that you're ownership a home that will allow y'all to grow and alter.

If you lot're engaged or pregnant, your dwelling house will need to be larger than it was when yous were living as a family unit of one or ii. If yous're planning to get a dog or a cat, you'll demand more than infinite than you probably have now. As you shop, think of your five- and x-year plans.

Take an Exit Plan if You're Buying With a Non-Marital Partner

People have enough of reasons for buying a business firm with someone they're not married to, whether it's objection to the establishment, finances or something else. However, many laws concerning homeownership aren't designed around people that aren't married. This is particularly important when one owner of the house decides to leave the other.

You should have an agreement in identify with respect to titling, mortgage payments, liability, repairs and more before you buy. All the same, considering real estate laws on the subject area vary from state to land, this is one situation where consulting a lawyer beforehand could be wise.

Await By the Paint Color

While looking for houses, it'due south common to observe that they've been busy in weird ways — or at least, in ways yous certainly wouldn't have washed. If all y'all have to judge a house on is sickly yellow walls, information technology tin exist tempting to dominion information technology out.

Yet, painting is peradventure the cheapest way to renovate a house, so deciding not to buy a place for $60,000 just because it requires a few hundred or even a grand dollars in pigment to suit your tastes makes no sense.

Plan Ahead for Your Article of furniture

If you have furniture that you lot desire to bring into your new dwelling, y'all probably already take some idea of where each piece will go. Nonetheless, if you're planning to upgrade your furniture, yous'll want to start taking notes as yous shop houses.

Across choosing your new furniture and deciding where it volition become in an unfamiliar environment, y'all also need to decide if you'll exist buying it all at once when you're already putting a downpayment on a house or if you'll infinite things out.

Don't Do Anything to Modify Your Financial Situation

Your pre-approval is founded on the information you provided when y'all made your application. That means any changes to your finances afterward could touch your unabridged situation. Information technology might fifty-fifty toll you the house of your dreams.

Because of that, when you're in the procedure of buying a business firm, yous shouldn't upgrade your automobile, change jobs, become married (unless you lot applied together) or change anything else financially significant. Doing and then could potentially lower the mortgage you're offered when it comes time to make an offer.

Consider the Housing Market in Your Timing

One of the things that may aid you lot decide when to purchase a home is the housing market itself. If y'all buy a habitation at the incorrect time, you might regret it for many decades to come, depending on the loan you get.

While some areas experience steady growth or declines in housing prices over time, they're unremarkably still susceptible to short-term booms and busts as well, so watching prices over fourth dimension could help you gain an reward. Interest rates on mortgages besides fluctuate and can mean yous end upward paying significantly more or less over time.

Don't Forget Past Debt as Yous Plan and Budget

Budgeting for the many expenses of homeownership — property taxes, extra utility bills, homeowners insurance and more — is certainly important. However, you also need to factor in existing expenses as well, especially past debt.

Not merely tin can your debt add to your monthly expenses, but it can likewise decrease how much money banks are willing to loan you. Higher debt is particularly troublesome when information technology comes to buying a house, since information technology'southward ofttimes large plenty to have a noticeable touch on how much yous can borrow.

Don't Fixate on the Price of the House

A lot of immature buyers fixate on the specific price of the firm they're interested in. They go it in their heads that every bit long as they can afford it with their cost of living and the sticker cost deemed for, they should exist good to become.

In reality, the purchase cost is but a small role of what determines if y'all can beget a house or not. A house in poor repair may end up costing far more than expected, while a well-insulated one may actually have lower heating bills than expected. The house's cost is certainly important, merely it'southward non the but factor to go on in heed.

Shop Effectually for the Correct Mortgage

You lot've been pre-approved for your mortgage, which is great. However, that'southward not where this loan journeying ends. You demand to shop around a scrap to find the exact fit for your needs and your finances, as not all mortgages are created equally.

Check out at least iii lenders or mortgage brokers to increase your chances of getting the best charge per unit possible. Check the reputations of the brokers and lenders online and always ask what starting time-fourth dimension buyers' programs or incentives are bachelor to you.

Don't Purchase a House Y'all Cannot Beget

This may seem like common sense. but never buy a firm you cannot beget. Unlike other situations where you lot spend too much coin, buying a house that's too expensive hurts you not merely in the nowadays, but well into the future, as mortgage payments leave yous poor for a long time.

A formula that some lenders suggest is paying no more than a tertiary of your gross income. Other lenders advise a much more than conservative stance of spending no more than than 28 percentage for all your housing-related costs, including taxes, insurance and mortgage payments.

Know Every Single Expense Involved

1 of the downsides to ownership versus renting is the sheer amount of paperwork and number of expenses you need to handle. There are numerous fees and taxes that you should be prepared to include in your upkeep so equally not to be surprised.

When you are looking at possible houses, make certain that your agent is willing to give you the big picture of how much the purchase will really cost yous. Information technology would be unfortunate to find your perfect house and then discover some other few thousand dollars in fees, knocking information technology out of your toll range.

Don't Worry Near the Ugly Carpet

Like paint, if a home has everything y'all're looking for except an ugly carpet that's tacky, uncomfortable or but plain gross, you can probably change it without also much hassle. You can either pay someone to alter the rug or find some decently priced squares and supervene upon it yourself.

Better yet, you might fifty-fifty pare it up and discover some beautiful hardwood floors underneath. While information technology's certainly not guaranteed, it is a possibility. There'southward null similar original hardwood floors in an old home to add course to a place.

Always Become a Business firm Inspection Earlier Buying

Information technology is of import to have a house inspection before you purchase a holding. If you're getting a loan, the lender may even require yous to go an inspection as function of your contract. A home inspection can help you ameliorate understand whatever structural or mechanical issues that are present.

Your real estate agent may advise an inspector, but it's important to do your own inquiry before agreeing to rent ane. Fees may vary, but on average, you lot tin can expect to pay anywhere from $300 to $450 for an inspection, with larger houses having college prices.

Don't Get Pressured Into Annihilation

It'due south important not to allow yourself to exist pressured into any sale. Not every agent has your best interests at center, and some are not above trying to crusade panic and anxiety to brand a sale and earn their commission. Until y'all sign the paperwork, you are under no obligation to purchase a house, no matter how many properties you have been shown.

If you lot are feeling pressured to make a buy yous are not comfortable with, walk away. If your agent is function of an agency, you may want to consider filing a complaint with their supervisor.

Consider Flooding Potential

One time you've plant a business firm you similar, determine whether or not it lies in a floodplain. The closer the firm is to h2o, the greater the run a risk there may exist flooding during storms. Even if the house isn't almost water, the property itself may be prone to collecting information technology, especially in the basement.

Houses in a floodplain require special insurance, which means they're pricier on a monthly footing also every bit in the result of a disaster. Other dangers to be aware of include tornadoes and especially seasonal fires.

Decide If Buying a Fixer-Upper Will Save You Money or Not

For some of us, the idea of a logroller-upper is a total thrill. Y'all can buy a house that's basically a trounce and build it upwardly from the floor, making information technology precisely what y'all desire in practically every way — bold the house has skillful bones.

While a logroller-upper can save money in the long run, it volition cost more in fourth dimension, and there'southward always the possibility that it needs more work than you anticipated. To be safe, y'all should accept a meaning savings reserve to deal with any unexpected expenses.

Investigate Neighborhoods

As they say, location, location, location. A beautiful dwelling house can be found in just about whatsoever neighborhood. Because of that, choosing a neighborhood to search in may be even more of import than the particular house you.

Earlier you make any commitments to a house, be sure to go to know the neighborhood you lot're considering moving to. Practise you lot experience safe and comfy in the customs? Are the schools the kind you lot'd want to send your kids — or future kids — to?

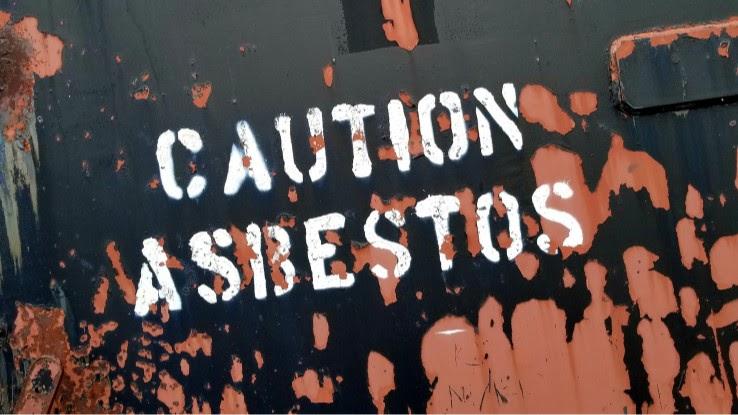

Brand Sure the Inspections Involve Checking For Asbestos, Mold and Radon

When you lot have the holding inspected, make sure there are no traces of asbestos, radon or mold. Asbestos was a frequently used building cloth up until 1977, and this cancerous material tin can cause the toll of repairs to skyrocket while destroying the resale value.

Radon is an invisible and odorless gas that can be nowadays in both air and water, and the tests for radon are much cheaper than the price of removal, which can easily be thousands of dollars. Additionally, mold is a wellness risk that should be checked for and removed by the seller.

Don't Settle for the First Firm You Like

While information technology tin exist tempting to settle for the first house whose picture you love, it's of import to run into the house in person and sentinel out what the neighborhood is like. Make sure you have a priority list of qualities that you demand in a business firm and the surrounding neighborhood.

Once you tour the houses and drive effectually each neighborhood, have extensive notes so you lot know what you enjoyed, how yous could employ particular unique aspects to meet your needs, and more. While each house seems distinct in the outset, they blend together quickly.

Remember to Negotiate Repairs

As noted previously, y'all'll probably need and desire a domicile inspection. If it reveals a need for any repairs, speak with the agent who is brokering the deal. Depending on the repairs needed on the property, information technology'due south possible to become the repairs thrown into your contract with the seller.

What usually happens is either the seller volition agree to pay to have the repairs done or they'll lower the price of the house appropriately. Depending on the nature and price of the repairs, either one could be in your or the seller'southward best interests, then yous'll demand to negotiate to find a solution.

Empathize the Homeowners Association

Before purchasing a house, you lot should decide if the property is governed past a homeowners association. Non all houses are role one, but some are, and they tin vary wildly in their implications for y'all, so it'southward important to know what you are getting into.

Most homeowners associations have like requirements, such equally annual dues and having to wait for the association to provide maintenance to common areas. However, the particulars of the clan and the personalities of the people involved may cause problems for yous down the route, so it'southward important to do your homework. One of the fastest ways to find out the quality of the grouping is to talk to people already living in the area.

Make the Right Offer on the House You Beloved

An important step to getting the firm of your dreams is making an offer the seller accepts. After finding the right place, your agent can help prepare the offer package. This package should include your offer, proof of funds, a copy of your pre-approval letter of the alphabet, terms and ideally a personal letter.

In most situations, a seller has 24 hours to make a counteroffer, and the two of you lot go back and forth until an understanding is made or 1 of yous walks away. One time you decide on that, the next footstep is signing a purchase agreement and making a deposit on the house. It'due south important to brand sure any offer you sign includes contingency clauses in case unexpected issues ascend.

Source: https://www.life123.com/home-garden/everything-consider-before-buying-first-home?utm_content=params%3Ao%3D740009%26ad%3DdirN%26qo%3DserpIndex

0 Response to "What You to Need Know About Buying an Older Home in Florida"

Postar um comentário